If you’re looking to cancel Self account, you might feel both relieved and uncertain. Maybe you’ve hit your credit goals, or a change in plans has shifted your financial strategy.

Either way, it’s a big step—and I’m here to guide you through it. Canceling a Self Credit Builder Account doesn’t have to be complicated, but questions often come up.

What happens to your credit score? Will you get a refund? How can you avoid mistakes during the process? This guide has the answers.

I’ll break everything down into simple, actionable steps. From timing your cancellation to minimizing fees and understanding the impact on your credit, you’ll find everything you need here.

By the end, you’ll feel confident in your decision—whether it’s closing your account now or waiting until the time is right. Let’s get started!

Understanding Your Self Credit Builder Account

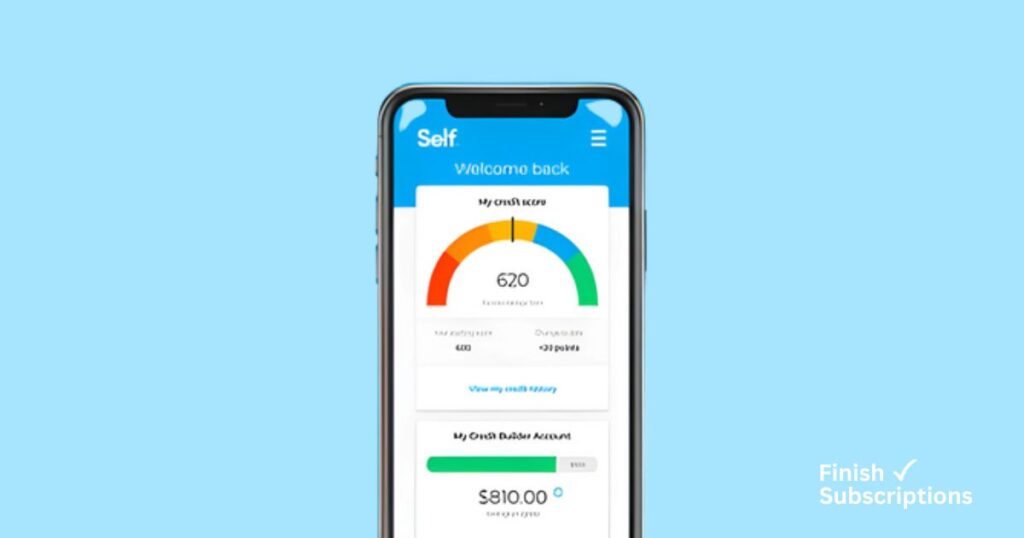

A Self Credit Builder Loan helps you build credit while saving money. Instead of receiving funds upfront, the loan amount is placed in an FDIC-insured Certificate of Deposit (CD), accessible after completing payments.

Monthly payments, including interest and fees, are reported to the three major credit bureaus, improving your credit profile.

Ideal for those with no or poor credit, this loan builds a positive credit history and promotes savings, as you unlock the CD funds at the end.

However, it includes fees and penalties, so on-time payments are crucial for maximizing its benefits.

Benefits of Using a Self Account

A Self account helps you build credit and save money simultaneously. By making monthly payments, you establish a positive credit history reported to the three major credit bureaus.

Your payments are held in a Certificate of Deposit (CD), creating savings while improving your credit score. It’s ideal for individuals new to credit or repairing their financial profile.

Self also offers a secured credit card, giving you another tool to strengthen your credit responsibly.

Why Do People Cancel Their Self Account?

People cancel their Self account for several reasons:

- Financial hardship: Managing monthly payments might become difficult, prompting users to close their Self account.

- Achieving credit goals: Once users reach their credit-building objectives, they may decide to cancel their Self Credit Builder account.

- Seeking better alternatives: Some look for other financial tools with lower fees or more flexible terms, leading to a Self account cancellation.

- Dissatisfaction with fees: The early closure fee or other associated costs can be a factor when deciding to close Self Credit Builder account.

- Changing financial priorities: Users might prefer focusing on savings accounts, investments, or different credit-building options, leading to Self account termination.

Before deciding to cancel, consider the potential impact of canceling a Self account on your credit score and evaluate whether it aligns with your long-term financial goals.

How to Cancel Self Account?

Canceling your Self account is a straightforward process, but it’s essential to follow the right steps.

Whether you’re using the Self dashboard, mobile app, or customer service, you’ll need to be mindful of certain details like fees or credit impact.

Here’s a complete guide to ensure you understand how to close Self Credit Builder Account effectively.

How to Cancel Your Self Account via Dashboard?

Canceling your Self account is straightforward, especially if you do it through the online dashboard.

Here’s a step-by-step guide to help you close your Self Credit Builder Account smoothly.

- Log In to Your Account: Start by logging into your Self account on the official website. Use your username and password to access the dashboard.

- Navigate to Account Settings: Once logged in, locate and click on the “Account Settings” or “Account Management” section. This is typically found in the top right corner of your dashboard.

- Find the Cancellation Option: In the settings menu, you should see an option to “Cancel Self Account” or “Close Account.” Click on this option to begin the cancellation process.

- Review Terms and Fees: Before you proceed, review any associated fees, such as an early closure fee, and check whether there are any pending payments or outstanding balances. It’s crucial to settle these before completing the process.

- Confirm Your Cancellation: Follow the prompts to confirm your cancellation request. You might be asked to enter additional details for security purposes, such as your social security number or the reason for canceling.

- Submit Your Request: After confirming, submit your request. You should receive a confirmation email within a few days, confirming the closure of your Self account.

Remember, canceling your account through the dashboard is the quickest and most convenient method. If you have any issues or need assistance, contact Self customer support for help.

How do I cancel my Self Account using the app?

Canceling your Self account through the mobile app is quick and straightforward. Here’s how you can do it in just a few easy steps:

- Open the Self App: Launch the Self app on your mobile device. Make sure you’re logged in using your username and password.

- Go to Account Settings: Tap the profile icon or menu in the top corner to access your account settings. Look for the “Account” section.

- Select “Cancel Account”: In the account settings menu, scroll down and select the “Cancel Account” option. You may be prompted to review the terms and conditions for cancellation.

- Confirm Cancellation: Follow the on-screen prompts to confirm that you want to cancel. Be sure to check for any potential early closure fees and confirm your decision.

- Final Step: Once confirmed, your Self account will be canceled. Keep an eye on your email for any final details or refund notifications.

By following these simple steps, you’ll successfully close your Self account without needing to contact customer support directly.

How To Contact Customer Service for Self Account Closure?

If you’re ready to close your Self account, contacting customer service is an essential step. Here’s how you can reach them for smooth assistance:

- Phone: Call Self’s customer support at (800) 667-0302. Their team is available during business hours to guide you through the closure process.

- Email: For non-urgent inquiries, you can send an email to help@self.inc. Ensure you include your account details and request for account cancellation.

- Live Chat: If you prefer an instant response, use the live chat feature on the Self app or website. This is an efficient way to get real-time help.

Self’s customer service team will walk you through the necessary steps, including any fees, refunds, and account closure instructions.

What Happens After You Cancel Your Self Account?

Once you decide to cancel your Self account, there are several key factors to consider. These include the return of remaining funds, effects on your credit score, and how to minimize potential damage.

Get a Refund of Remaining Funds After Cancelling Your Self Account

- Clear Pending Payments

Make sure all payments are up to date and there are no outstanding balances before requesting a refund. - Check for Early Closure Fees

If you’re canceling early, review the early termination fees. These may be deducted from your refund. - Complete the Account Cancellation

Cancel your Self account via the app or by contacting Self customer support. Ensure the account is fully closed. - Request Refund of Remaining Funds

If you have a security deposit or balance, request a refund. Self will return the remaining funds to your linked account. - Wait for Processing

Refunds typically take 1-3 weeks. Contact Self customer support if there are delays. - Confirm Refund

Ensure the refund is credited to your bank account and reach out to customer support if not.

By following these steps, you’ll receive your refund after canceling your Self account.

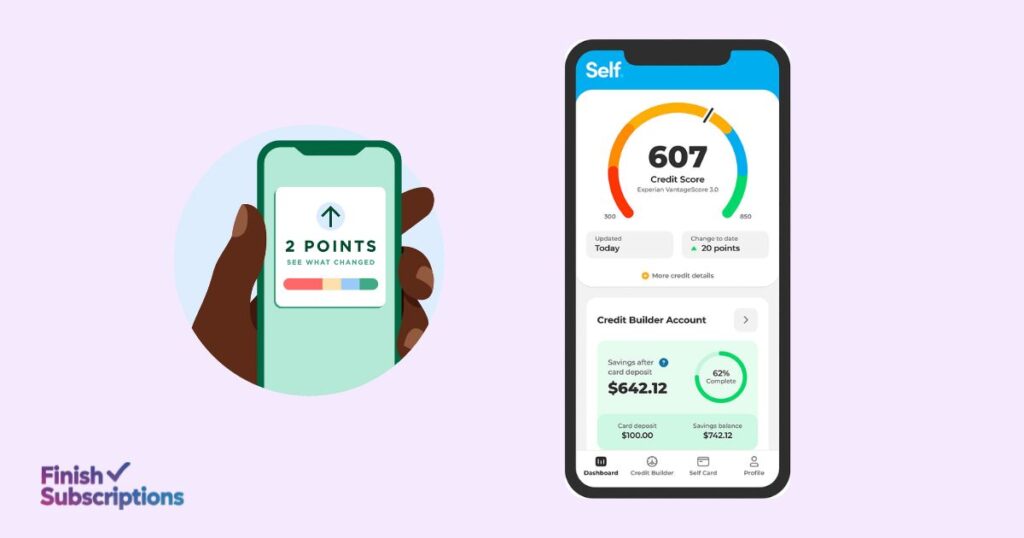

Impact on Your Credit Score

When you cancel your Self Credit Builder account, it can impact your credit score in various ways, depending on your account’s standing and payment history. Here’s what you need to know:

- Credit History

Canceling a Self account may shorten your credit history, especially if it’s one of your oldest accounts. A shorter credit history can slightly lower your credit score since length of credit is a factor in scoring models. - Credit Utilization

If you cancel a Self Visa® Credit Card or credit builder loan, it can affect your credit utilization ratio. This ratio compares your total credit used to your total credit available, and a higher utilization rate may hurt your score. - On-Time Payments Matter

If you’ve consistently made on-time payments, the impact on your score will likely be minimal. Your positive credit history can remain on your report, boosting your creditworthiness even after cancellation.

To mitigate any negative effects, keep your other accounts in good standing, make timely payments, and ensure your credit utilization remains low.

Tips to Mitigate Credit Impact

When you decide to close your Self account, it’s crucial to consider the potential impact on your credit score. Here are a few steps to help minimize any negative effects:

- Ensure on-time payments: Before canceling, make sure all payments are up to date. A history of on-time payments boosts your credit.

- Keep credit utilization low: If you have a Self Credit Builder loan, maintaining a low balance can prevent significant score drops.

- Gradually close accounts: Avoid closing multiple credit accounts at once, as this can harm your score by reducing available credit.

How do I avoid Early Closure Fees When Canceling Self Account?

Avoiding early closure fees when canceling your Self account requires careful attention to your loan or account status. Here are key steps to follow:

- Pay Off the Loan: Before canceling, ensure your loan balance is fully paid. Outstanding balances or missed payments can trigger early closure fees.

- Review the Terms: Check your Self account agreement for any early termination clauses. These terms will outline any penalties for closing the account before the term ends.

- Contact Customer Support: Reach out to Self’s customer service to discuss your cancellation and confirm that you’ve met all the requirements to avoid fees.

- Consider Alternatives: If you’re unable to complete payments, discuss alternative options with Self to possibly avoid penalties, such as transferring your balance to another account.

By paying attention to these details, you can cancel your Self account without incurring unwanted fees.

How To Close Self Secured Credit Card

If you’re looking to close your Self Secured Credit Card, it’s important to follow a few key steps to avoid potential fees or credit score issues. Here’s a quick guide:

- Pay off Your Balance: Before you cancel your account, make sure to pay off any outstanding balance. This includes your monthly payments or any remaining charges. Check your Self app or online dashboard for the exact amount due.

- Request a Refund for Your Deposit: Since the Self Secured Credit Card requires a security deposit, you’ll need to request a refund once your balance is cleared. Ensure your account is in good standing to avoid penalties.

- Contact Self Customer Support: Call or email Self customer service to formally close your account. You may need to provide personal details, such as your social security number or account number, to verify your identity.

- Confirm Closure: After completing these steps, ask for confirmation in writing that your Self account has been closed. Keep track of the refund process to ensure your deposit is returned promptly.

Closing your Self Credit Builder account properly helps avoid any negative impact on your credit score or fees.

Refund and Cancellation Policy Details

If you’re thinking about canceling your Self account, it’s important to understand the refund and cancellation policies to avoid surprises.

Self Financial offers tools like the Credit Builder Account and secured Visa® Credit Card. Their policies ensure you’re informed about any refunds, cancellation fees, and what to expect when closing your account.

Whether you’re closing your Self Credit Builder Account or stopping your monthly payments, follow the correct steps to avoid penalties and ensure you get any applicable refunds.

Refund Timeline and Conditions

Wondering about your refund after canceling your Self Credit Builder Account? Here’s what to expect:

- Refunds are usually for security deposits or early closure fees, if applicable. If you’ve made payments or have a refundable balance, Self will issue the refund once all payments are cleared.

- If your account is paid off and in good standing, your security deposit may be refunded after account closure.

Refund Timeline:

- Security deposits are generally refunded within 30 days after account closure.

- Fees: Early termination fees or remaining balances can affect the timeline.

- Conditions: Your account must be clear of pending payments and balances. Refunds may be denied if terms are violated (e.g., missed payments).

To ensure your eligibility for a refund, double-check that your account is fully paid, with no outstanding balances. Self’s customer support is available to help clarify any refund-related questions.

Escalation Steps for Refund Delays

If your refund is delayed, here’s how to speed things up:

- Contact Customer Service: Reach out to Self customer support via help@self.inc or call their customer service number. Have your account details ready.

- Check Account Status: Ensure all payments are cleared, and your account is closed properly. Sometimes delays happen if there’s an unresolved balance.

- Follow Up: If you’ve already contacted customer support and there’s no response, ask for a supervisor or manager to assist further.

- Document Everything: Keep a record of all communication, including dates, times, and the names of representatives you’ve interacted with.

Remember, refunds can take time, but by following these steps and being proactive in your communication, you can ensure a smoother resolution.

Common Issues During Cancellation

When it comes to canceling your Self account, you may face a few bumps along the way. Here’s a breakdown of some common issues and how to handle them effectively.

Problems Accessing the Dashboard

If you’re struggling to access your Self account dashboard, it’s often due to login issues or technical glitches. Here’s how to resolve it:

- Check your login details: Ensure your username and password are correct.

- Reset your password: If you’ve forgotten it, follow the password reset steps on the login page.

- Clear cache or try another device: Sometimes, technical problems are browser-related. Try clearing your cache or accessing your account on a different device.

If you still can’t log in, contact Self customer support for additional assistance.

Delays in Refund Processing

A delayed refund after canceling your Self account is a frustrating issue. Here are some reasons why delays might happen:

- Pending payments: If there are any remaining balances, refunds may be delayed.

- Security deposit refund: Refunds can take up to 30 days, depending on account status.

- Late fees or early closure charges: These can slow down the process.

If your refund is delayed, follow up with Self’s customer service using their contact number or email.

Difficulty Reaching Customer Service

If you’re having trouble reaching Self customer support, don’t worry! Try these alternatives:

- Email: Send a detailed inquiry to help@self.inc.

- Automated phone system: If calls are not getting through, consider leaving a message for a callback.

Persisting with these channels should help you get the assistance you need.

Conclusion

Canceling your Self account doesn’t have to be a complicated process if you follow the right steps.

Whether you’re closing your Self Credit Builder account or just want to deactivate your Self Visa® Credit Card, the key is to carefully manage the cancellation to avoid unnecessary fees or negative impacts on your credit score.

Make sure to check if any outstanding balances or scheduled payments remain before initiating the closure.

Contact Self customer support if you have questions or need assistance with the process, especially if you’re concerned about refunds or the early closure fee.

If you’ve decided it’s time to end your Self account, following the steps outlined in this guide will help ensure a smooth closure.

Remember, understanding the terms, refund policies, and cancellation procedures will help you avoid any surprises along the way.

Have any more questions? Feel free to leave a comment below, and don’t forget to share this guide with others who might find it helpful!

Frequently Asked Questions (FAQs)

Can I Cancel a Scheduled Payment Before It’s Processed?

Yes, you can cancel a scheduled payment before it’s processed by contacting Self’s customer support at 877-883-0999.

What Are the Fees for Closing My Account Early?

Self may charge an early closure fee if you close your Credit Builder Account before the loan term ends. It’s advisable to review your loan agreement or contact Self’s customer support for specific details.

How Will Cancelling Affect My Credit Score?

Closing your Self Credit Builder Account can impact your credit score. If your account is in good standing, it will be reported as closed and paid as agreed.

However, if you have no other credit accounts or have other negative items on your credit, your credit score may drop when your Self account closes.

What Documents Are Required to Close My Account?

To close your Self account, you’ll be required to provide your account information and verify your identity. Specific documents may vary; it’s best to contact Self’s customer support for precise requirements.

How Long Does It Take to Cancel a Self Account?

Your Self account will close at 11 PM CST on the same day you request cancellation.

Can I Cancel My Self Account Over the Phone?

Yes, you can cancel your Self account over the phone via calling 877-883-0999.